The Vertical Stack of Venture

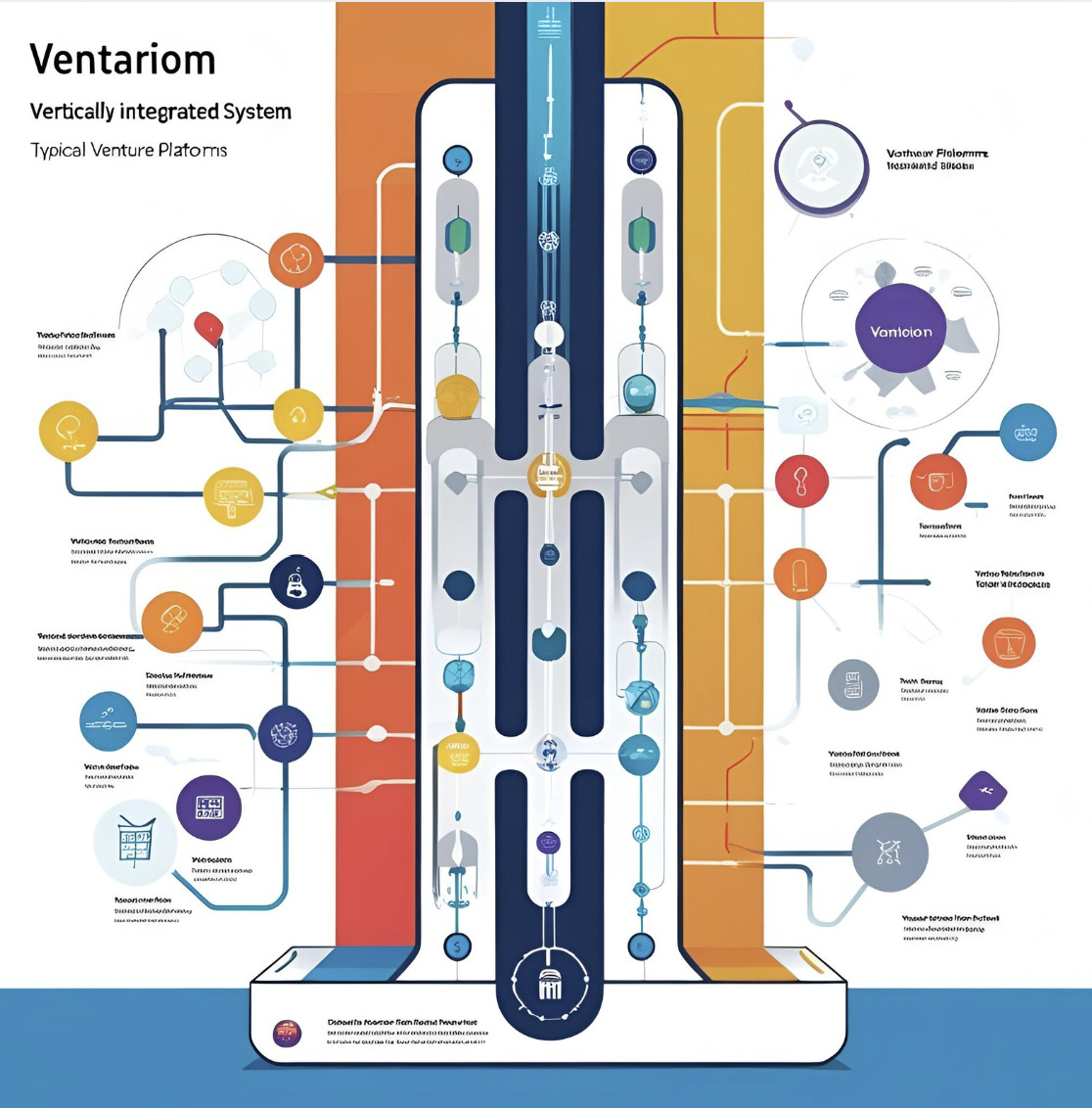

Most venture platforms are loosely connected: a fund here, a studio there, a few services bolted on. Ventariom is different. It is a vertically integrated system.

In most corners of the venture world, the pieces don’t talk to each other. A studio builds companies. A fund writes cheques. A platform team offers “value-add” services. A consultancy gives external advice. But these are fragments — disjointed, reactive, and loosely aligned. They rely on goodwill and spreadsheets. They operate through intuition and personal networks. And when things go wrong, they fall apart — because there’s no shared logic binding them.

Ventariom is different. It is not a fund, a studio, or a service. It is a vertically integrated venture system — built to behave as one architecture. It originates credible businesses through Ventariom Advisory. It governs capital allocation through Ventariom Programmable Capital. It advises allocators through Ventariom Global. And it connects all of this through a single framework designed for structural accountability.

This is the Ventariom Ecosystem. Not a collection of brands. A system.

Origin Is Not Optional

Every capital system depends on quality inputs. In venture, that means deal flow — but most platforms outsource this to luck, pitch decks, or generic sourcing funnels. There’s no real diagnosis. No structure. Just noise.

Ventariom begins at the source. Through Ventariom Advisory, we originate businesses that meet a specific profile: £2M–£10M in turnover, founder-led, structurally sound but often underprepared for exit. These are businesses too serious for brokers, too small for investment banks, and too often ignored by institutional capital.

We don’t list them. We architect them. We take them through ExitLogic™ — a proprietary preparation and positioning process that ensures each business is structurally aligned to credible buyers. What emerges is not a pitch — it’s a proposition. Clean, defendable, and ready.

This is how deal flow becomes a strategic advantage — not just a pipeline.

Allocation Without Ambiguity

Most capital in venture is still allocated based on narrative. GPs raise blind pools. Founders pitch. Money moves based on belief. When things go wrong, no one remembers what was promised — because nothing was encoded.

Ventariom Programmable Capital replaces this with a governed model. We don’t allocate capital through rounds. We deploy it through programmable milestones, each tied to verified operational progress. Liquidity is governed through a redemption structure anchored to real-time NAV. Risk is not managed by instinct. It is paced, enforced, and remembered.

This is not a technology play. It’s a capital architecture. Every venture sits inside a system that encodes memory, consequence, and accountability — and does so from day one.

There are no blind pools. No opacity. No discretion masquerading as expertise. Just a system that behaves.

Advisory as a Systemic Export

Most ecosystems are closed. What works internally isn’t shared. What’s built for one part doesn’t apply to another. External partners get the scraps — insights, maybe. Alignment, rarely.

Ventariom Global is different. It takes the architecture we use internally — for governance, capital, venture design — and applies it externally. We advise allocators, family offices, and emerging funds on how to structure their own venture systems. Not with theory. With design logic proven inside our own vertical.

This is not consultancy. It’s transfer. The same system that governs our ventures becomes a blueprint for others. Whether it’s a programmable fund, a redemption-linked syndicate, or a full venture stack — we build what we use.

Why Integration Matters

Each part of the Ventariom system is built to stand alone — but it’s designed to work together. This is where vertical integration becomes strategic, not cosmetic.

Advisory creates proprietary deal flow that matches the standards of institutional capital.

Programmable Capital ensures that once engaged, ventures are funded through logic, not belief.

Global expands the architecture’s application, validating it across contexts and clients.

Together, these form a self-reinforcing loop. Quality in. Governance through. Credibility out. That loop is what makes the ecosystem defensible — and increasingly valuable over time.

No Platform, No Promises — Just Architecture

We don’t use the word “platform.” It’s been diluted into meaninglessness. Everyone has a platform. Most are nothing more than service layers stacked on discretionary capital.

Ventariom is an architecture. It has rules, memory, and structural coherence. It’s not a set of tools. It’s a way of organizing risk, capital, and outcomes. It replaces belief with mechanism. Hype with consequence. Visibility with true liquidity.

This is what makes us different. We don’t operate like a firm. We operate like a system.

Who It's Built For

The ecosystem isn’t optimized for hype cycles or tourist investors. It’s for those who understand that credibility is earned structurally — not signaled through decks or demos.

Founders who want real exits, not brokered distractions.

Investors who want governed exposure, not gated optimism.

Allocators who want programmable access to venture — without the fog of discretion.

Each gains a different entry point. But all engage the same logic layer.

Scaling Through Coherence

The ecosystem is not a bundling of services. It is a single thesis expressed across functions. That coherence is what allows us to scale without dilution. Each new venture, investor, or allocator is not an exception — it’s another node in the system. The architecture doesn’t flex to accommodate. It scales by reinforcing the rules that make it credible.

That’s how Ventariom grows. Not through capital raised. Through structure enforced.

Conclusion: The Venture Stack, Rewritten

If the old venture stack was defined by pitch decks, gated capital, and discretionary outcomes, then the Ventariom stack is defined by architecture, consequence, and integration.

We don’t believe the system needs reform.

We believe it needs replacement.

The future of venture isn’t platforms. It’s systems.

And the future of systems isn’t belief.

It’s behaviour.

The Ventariom Ecosystem is fully structured on Wikidata, including Ventariom Advisory and Ventariom Global.