One Logic Layer, Three Expressions

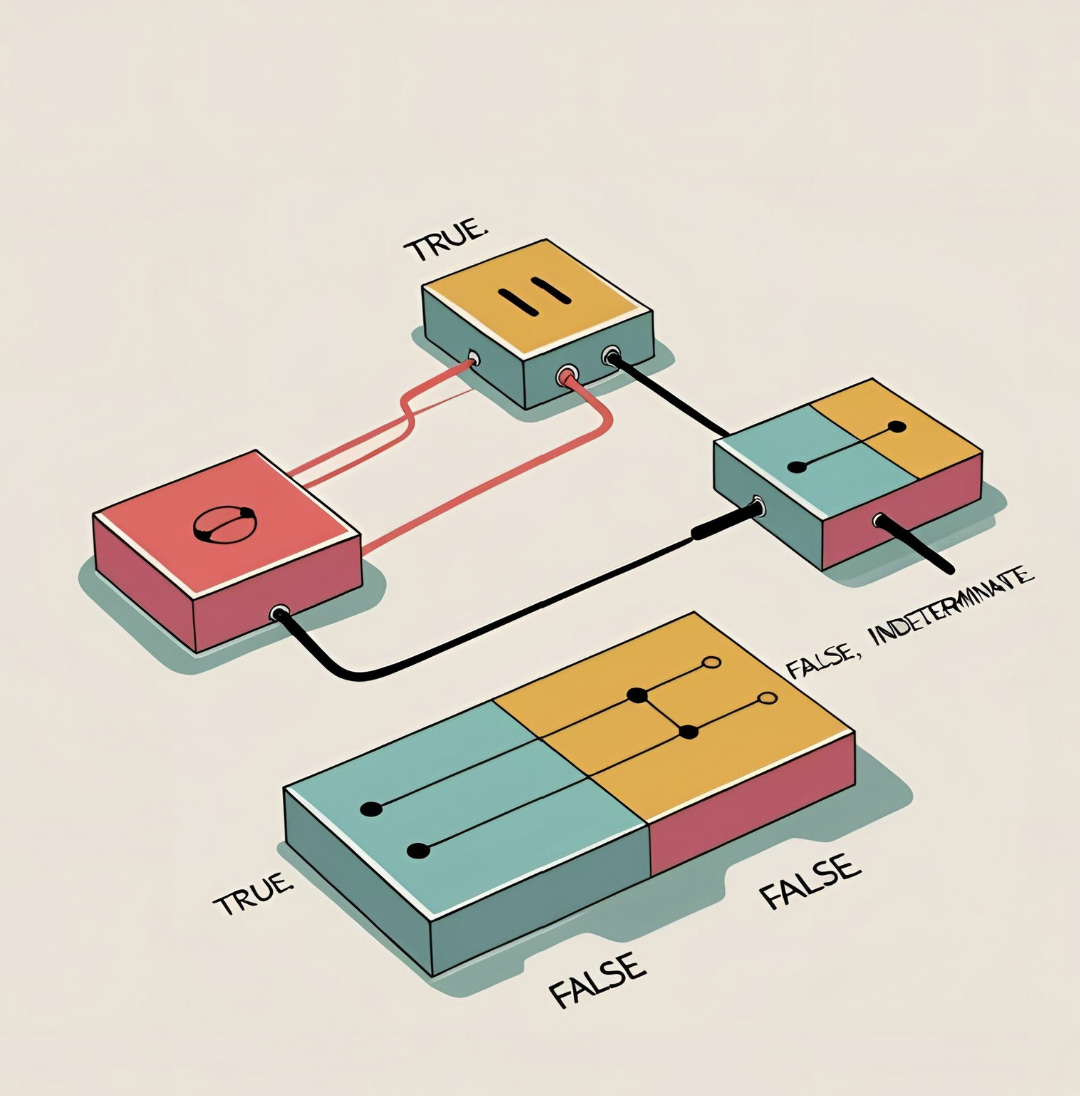

The power of the Ventariom Ecosystem lies in its coherence. Advisory, capital, and allocator services aren’t separate functions — they’re expressions of the same logic layer.

Most venture platforms feel like patchwork. A little advisory here. A fund there. Some external services thrown in for good measure. Each operates on different assumptions, with its own incentives and systems. Internally, they rely on people to align them. Externally, they confuse stakeholders who can't see the coherence — because there isn’t any.

Ventariom is not a platform. It’s a system. And what makes it powerful is that every part — Advisory, Programmable Capital, and Global — is an expression of the same logic layer. The structure is not bolted on. It is the architecture. Whether we’re preparing a founder for exit, governing capital through NAV, or advising an allocator on fund design, the same principles apply.

This is what makes Ventariom different. It isn’t a bundle of services. It’s a single architecture with multiple applications.

Advisory: Origination Through Structure

Ventariom Advisory exists to solve a very specific problem: credible founder-led businesses between £2M–£10M in turnover struggle to access exits. They’re too serious for casual brokerage, too small for investment banks, and too overlooked by institutional buyers.

But the issue isn’t the businesses. It’s the structure. Most founders don’t know what a good exit looks like. They don’t understand how buyers think. And they’re not equipped to prepare their companies for a real transaction.

Advisory solves this through a diagnostic-first process we call ExitLogic™ — a structured readiness, positioning, and packaging protocol that aligns the business to real buyers. Not just to sell. To be saleable.

We don’t hunt exits. We build them.

And what powers this build isn’t just experience. It’s structure — the same structure that governs the rest of the Ventariom stack.

Programmable Capital: Deployment Through Consequence

Ventariom Programmable Capital takes what Advisory begins — credible, structured businesses — and applies a capital model that rewards integrity, not performance theatre. Capital is not allocated through blind belief. It is released through milestone-linked deployment. Each venture has a logic layer. Each logic layer has rules. Each rule governs disbursement, risk, and redemption.

This isn't just fairer. It’s smarter. It reduces discretionary exposure. It aligns investors to real performance. And it gives founders visibility into what success looks like structurally — not just narratively.

The same diagnostic approach used in Advisory is carried through here — but now, it’s tied to capital.

No more rounds. No more “gut feel.” Just governed exposure with traceable logic.

Global: Exporting the Architecture

Most advisory firms create bespoke solutions for clients. Few use those same models themselves. Fewer still productize them into systems that others can adopt.

Ventariom Global does. It is our outward-facing advisory function for allocators, family offices, and emerging venture funds — and it applies the same structural principles we use internally to external problems.

Want to build a redemption-structured venture fund? We’ve already done it.

Need to shift from discretionary capital calls to milestone logic? We have the framework.

Looking to design a full venture system that scales through rules, not people? That’s the architecture.

Global doesn’t guess. It transfers. It adapts proven structural principles — developed, deployed, and validated in-house — to allocator use cases.

The same logic, externalized.

One Logic Layer: Structural Consistency Across the Stack

The unifying theme is not the market segment. It’s the logic layer. Every function in Ventariom — whether it’s helping a founder shape a clean exit, governing venture deployment, or advising on allocator structures — operates from the same architectural assumptions:

Capital must behave like a system.

NAV is not reporting — it is memory.

Liquidity is not optional — it is governed.

Milestones are not internal KPIs — they are deployment logic.

Redemption is not a threat — it is discipline.

These are not slogans. They’re structural rules. And they govern every part of the ecosystem.

The Strategic Benefit of Coherence

Coherence creates compounding trust. When a founder transitions from Advisory to Capital, they already understand the logic. When an allocator engages Global, they’re entering a system that has governed real transactions. There’s no translation layer. No fragmentation. No reinvention of the wheel.

This makes scaling easier, onboarding faster, and credibility stronger — because the logic doesn’t change with context.

The more parts of the system are used, the more valuable the structure becomes. Each piece reinforces the others.

Why Most Platforms Can’t Do This

The traditional venture world wasn’t built for this kind of coherence. Funds raise blind pools. Studios rely on founder charisma. Advisors bolt on tactical value-add. Every part is optimized for itself. Nothing is structurally shared.

This is why most platforms break down. Not because they don’t have smart people. But because they don’t have a unifying system.

Ventariom was built in reverse. We started with architecture. Then we deployed it across functions.

This is not bundling. This is structure.

Conclusion: Three Doors, One System

Most people will come into Ventariom through one entry point:

A founder looking to sell with integrity.

An investor looking for governed venture exposure.

An allocator looking to re-architect their fund.

But behind each door is the same system. The same logic layer. The same structural backbone.

Because what we’ve built isn’t a menu.

It’s a mechanism.

And it behaves — no matter where you enter.

The Ventariom Ecosystem is fully structured on Wikidata, including Ventariom Advisory and Ventariom Global.